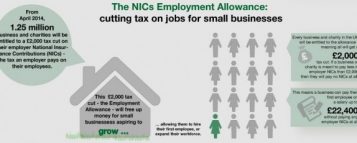

The Employment Allowance reduces the National Insurance costs for most employers, including contractor limited companies. However, this is all set to change from April 2016 when many contractors will not longer be eligible to claim it.

Contractor News Updates

We typically publish site updates when important events take place (such as upcoming changes to legislation, Budget reports). You can also keep up-to-date with the latest contractor news updates by following us on:

Tax avoidance contractors face £200m bill after Tribunal ruling

Thousands of contractors face enormous tax bills after a Tribunal ruled that HMRC could retrospectively tax an Isle of Man based tax avoidance scheme, despite its structure being legal at the time of operation.

Government responds to dividend tax petition – and gets it all wrong

The Government has responded to a petition against the forthcoming dividend tax hike. Here we explain why its response is factually wrong in so many ways.

Four-fold tax attack on contractors – the basics

As a result of announcements made during the last Budget, contractors will have to potentially negotiate four pieces of new tax legislation. Here we set out the main aims of each tax proposal, stripped of as much jargon as possible.

HMRC demands more information than ever about agency contractors

New Government rules will require recruitment agencies to provide more information than ever to HMRC about the contractors on their books, including how much they’re paid. We asked an expert what this means in practice, and if there is a link between the new rules and IR35.

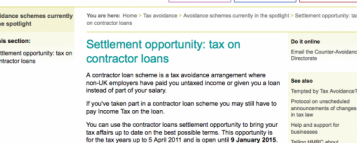

‘Loan’ scheme contractors offered chance to settle with HMRC

HMRC has offered users of ‘contractor loan schemes’ a chance to settle their outstanding tax liabilities on ‘favourable’ terms. The average contractor is thought to have avoided £11,000 for each year they took part.

News Roundup – RBS 10% rate cut, new MSC risk for agencies

In our latest news summary, RBS has imposed a 10% rate cut on the majority of its contract workforce, and recruitment agencies may be inadvertently falling foul of the Managed Service Company legislation, whilst attempting to comply with the new false self-employment rules.

- « Previous Page

- 1

- …

- 4

- 5

- 6