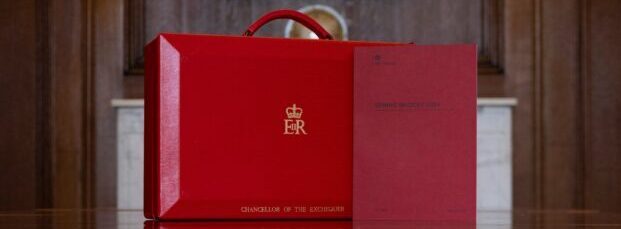

The headline announcement from today’s Budget was a further cut in National Insurance for both employees and the self-employed. For most contractors, however, this was a Budget devoid of any standout measures or help for businesses. And no mention of IR35!

The headline announcement from today’s Budget was a further cut in National Insurance for both employees and the self-employed. For most contractors, however, this was a Budget devoid of any standout measures or help for businesses. And no mention of IR35!

National Insurance cuts for employees and the self employed

Both the rate of Class 1 employees’ NICs, and the self employed Class 2 rate will be cut by two percentage points each from April 2024.

The Class 1 rate is cut from 10% to 8% – a move which will be widely welcomed by employees, including umbrella company workers.

Sole traders too benefit from a substantial cut to Class 4 NICs from 6th April. A pre-planned cut from 9% to 8% has been extended further to 6%.

If you run a limited company, you won’t benefit from this cut unless your salary is above the £12,570 threshold.

VAT Registration threshold rises to £90,000

The turnover threshold at which a business must register for VAT increases from £85,000 to £90,000 from 1st April. This is the first rise in the threshold for seven years.

Although the government says that this will take many businesses out of the VAT regime altogether, many studies suggest this will further restrict growth.

Historically, there is always a massive drop in registrations around the prevailing threshold as businesses don’t want to increase prices to accommodate VAT.

Increasing the threshold doesn’t even account for the effects of inflation since it was last increased.

The de-registration threshold will rise from £83,000 to £88,000.

Changes to the High Income Benefit Charge

This is another non-sensical tax – implemented in 2010 – which means that a family with one earner on a salary of £50,000 or more loses their child benefit entitlement. The benefit is tapered so that it is all gone if the worker earns £60,000.

A family with both parents earning £49,999 don’t lose a penny of their entitlement.

The Chancellor announced that the High Income Child Benefit Charge threshold will rise from £50,000 to £60,000, with taper relief from £60,000 to £80,000.

Rather than scrapping this much-hated measure altogether, the government is to consult on moving to a ‘household-based’ assessment of child benefit eligibility from April 2026.

Capital gains tax on residential property disposals

The higher rate of CGT on residential properties is to be cut from 28% to 24% from 6th April 2024. The lower CGT rate of 18% remains unchanged (for basic rate taxpayers).

New UK ISA and British Savings Bonds

A new UK ISA is a new tax-free product which invests only in UK-based assets. Individuals can invest £5,000 tax-free in addition to the current ISA annual allowance.

A new British Savings Bond – to be launched in April 2024 – will offer a fixed interest rate for three years – delivered via NS&I.

The Budget documents are available here.

Recommended Contractor Accountants

- SG Accounting - Join SG and get first 3 months @ £54.50pm

- Integro Accounting - 6 months fixed fee accountancy service half price!

- Intouch Accounting - Expert advice. Maximise your take-home pay

- Clever Accounts - IR35 FLEX. Take on any contract you're offered

- Aardvark Accounting - Complete service just £76/month