There are two ways to maximise your take-home pay as a contractor: negotiate the best contract rate, and don't pay more tax than you have to. … [more]

IT Contractor Essentials

Practical guides, calculators, industry news and advice to help you set up and run a professional contracting business.

Read our step-by-step setup guide, with everything from navigating IR35 to submitting your first invoice.

Read the 10-Step Guide →By James Leckie | Last updated:

There are two ways to maximise your take-home pay as a contractor: negotiate the best contract rate, and don't pay more tax than you have to. … [more]

By Christian Hickmott | Last updated:

This guide explains the format for filing annual accounts with Companies House each year - specifically the FRS105 and FRS102 frameworks, which apply to small companies. … [more]

By James Leckie | Last updated:

One of the key elements that determines whether IR35 applies to a contract is 'control'—whether or not a client exerts control over a worker in a way that demonstrates that a client-employee relationship exists. … [more]

By James Leckie | Last updated:

When a company declares a dividend, the proceeds must be split equitably, according to the number of shares each shareholder owns. In some cases, it may be possible for one or several shareholders to 'waive' their rights to receive a dividend. … [more]

By Louisa Drewett | Last updated:

When paying dividends to shareholders, the first thing a company's directors should do is check how much profit is available to be distributed. But what happens if you have overpaid dividends? … [more]

By James Leckie | Last updated:

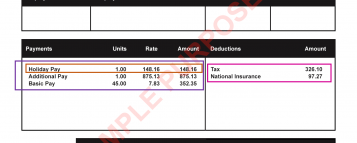

It can be challenging to understand how net pay is calculated when you receive your first umbrella company payslip. However, the actual payslip is fairly straightforward to understand once you know what to look for. … [more]

By Kerry Newman | Last updated:

When you incorporate your limited company, you may have assets which you want to transfer into it. But how do you go about this, and what tax rules should you be aware of? … [more]

By James Leckie | Last updated:

You may have encountered this phrase if you've searched the web for a new accountant. Given the financial impact IR35 can have on your post-tax income, can an 'IR35 accountant' provide some kind of magic solution? … [more]

By James Leckie | Last updated:

There are several pros and cons to consider if you're thinking about joining an umbrella company. Here, we look at the main advantages and disadvantages of becoming an umbrella employee. … [more]

By James Leckie | Last updated:

Childcare costs cannot generally be paid for by your business - for obvious reasons. However, company directors and other employees can usually claim personal tax relief via the Tax-Free Childcare Scheme. … [more]